reverse tax calculator ny

Enter the total amount that you wish to have calculated in order to determine tax on the sale. You should use one of the forms below to compute your estimated tax payments.

Reverse Mortgage Closing Documents Explained Goodlife

Here is how the total is calculated before sales tax.

. Enter the security code displayed below and then select Continue. Us Sales Tax Calculator Reverse Sales Dremployee A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Enter the sales tax percentage.

The calculator will show you the total sales tax amount as well as the county city and special. If you are married and filing a joint New York State income tax return both spouses should establish their. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

Depending on the zipcode the sales tax rate of New York City may Find your GSTHST rebate for a new home. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. The first script calculates the sales tax of an item or group of items then displays the tax in raw and rounded forms and the total sales price including tax.

Enter the sales tax percentage. Learn how to calculate sales tax by following. New York Income Tax Calculator.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of 500k or less. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts.

Penalty and Interest Calculator. The maximum taxable earnings for social security tax is 142800 for the year 2021. Certain churches and non-profits are exempt from this payment.

The following security code is necessary to prevent unauthorized use of this web site. It is very easy to use it. Reverse Tax Calculator 2022-2023.

Enter the sales tax percentage. 805 cents per gallon of regular gasoline 800 cents per gallon of diesel. The social security tax rate is 62 of your gross income and the medicare tax is 145 of gross income.

Download this app from Microsoft Store for Windows 10 Windows 81 Windows 10 Mobile Windows Phone 81. Living in New York City adds more of a strain on your paycheck than living in the rest of the state as the Big Apple imposes its own local income tax on top of the state one. In parts of the state like New York City all types of taxes are even higher.

Reverse Sales Tax Calculator of New York for 2020 Q1. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions. The only thing to remember in our Reverse Sales.

Learn more about your NY UI rate here. You can pay electronically check balances and review payments in your estimated tax account by creating an Online Services account. The harmonized sales tax or hst.

52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. If you know the total sales price and the sales tax percentage it will calculate the base price before taxes. If youre a new employer youll pay a flat rate of 3125.

Tax rate for all canadian remain the same as in 2017. New York is generally known for high taxes. The state sales tax rate in New York is 4000.

Amount without sales tax QST rate QST amount. How to estimate the tax. Reverse sales tax calculator ny Monday March 7 2022 Edit.

Instead of using the reverse sales tax calculator you can compute this manually. See screenshots read the latest customer reviews and compare ratings for Reverse Tax Calculator. This valuable tool has been updated for with latest figures and rules for working out taxes.

That entry would be 0775 for the percentage. The december 2020 total local sales tax rate was 7375. Overview of New York Taxes.

Enter the final price or amount. Single pay additional 09 in Medicare taxes if income over 200000 and 250000 for married filing jointly. Overview of New York Taxes.

On the first 11800 each employee earns New York employers also pay unemployment insurance of between 0525 and 7825. The New York Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New York State Income Tax Rates and Thresholds in 2022. New York City Income Tax Brackets 2021.

Literally any combination of options works try it - from swapping to. Current HST GST and PST rates table of 2022. New York State Tax Quick Facts.

Following is the reverse sales tax formula on how to calculate reverse tax. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. See the article.

It uniquely allows you to specify any combination of inputs when trying to figure out what your gross income needs to be for the desired net income. New York Unemployment Insurance. On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

New York Sales Tax Calculator Reverse Sales DrEmployee. View all NYC NYS Transfer Tax rates including the higher rate for commercial and 4-or-more family homes here. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

The Property Tax database calculates the combined property tax rate and total average property tax bill including schools and local governments in every New York locality. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. 3078 - 3876 in addition to state tax Sales tax.

Use this database to calculate the all-in property tax bill in a given locality or to compare property tax burdens among multiple localities. Amount without sales tax GST rate GST amount. You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code.

Details of the personal income tax rates used in the 2022 New York State Calculator are published below the. How to Calculate Reverse Sales Tax. You can use our new york sales tax calculator to look up sales tax rates in new york by address zip code.

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

How To Get Out Of A Reverse Mortgage Lendingtree

Home Mortgage Loan Stock Illustration Illustration Of Equity 26958976 Home Mortgage Reverse Mortgage Mortgage Loans

Fha Reverse Mortgages Hecms For Seniors Purchase Or Refinance Mortgage Payoff Reverse Mortgage Mortgage Loans

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Loan Advisors 714 271 8524 Reverse Mortgage Mortgage Loans Mortgage Calculator

Reverse Sales Tax Calculator Calculator Academy

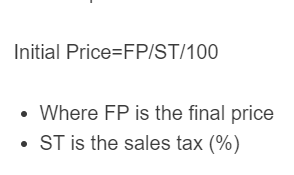

How A Reverse Mortgage Purchase Works Basics Down Payment Eligibility

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Stock Split Excel Calculator And General Electric Ge Example

How To Calculate Sales Tax Backwards From Total

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator Calculator Academy

Sales Tax Recovery Reverse Sales Tax Audit Pmba

Reverse Asin Lookup For Selling On Amazon Sageseller

Reverse Sales Tax Calculator Calculator Academy

What Is A Reverse Mortgage And How Does It Work Money

Here Are The Income Requirements For A Reverse Mortgage

College Debt And Home Buying Reverse Mortgage Finance Loans

Reverse Stock Split Excel Calculator And General Electric Ge Example